Property prices across Greater Sydney are expected to remain out of reach for individuals earning a single median income for at least the next decade.

A recent study assessing housing affordability across Greater Sydney has found that individuals earning the median part-time or full-time income in NSW are unable to afford property purchases without additional financial support, including the ‘bank of mum and dad’.

Published earlier this month in the journal Cities, the study projects Sydney’s housing market from 2022 through to the end of 2031, based on an analysis of market trends from 2004 to 2021.

The study, titled, “Entry affordability of employment types: Evidence along the theory of full-time and part-time wage differentials”, examined current entry affordability of income earners for strata and non-strata property types.

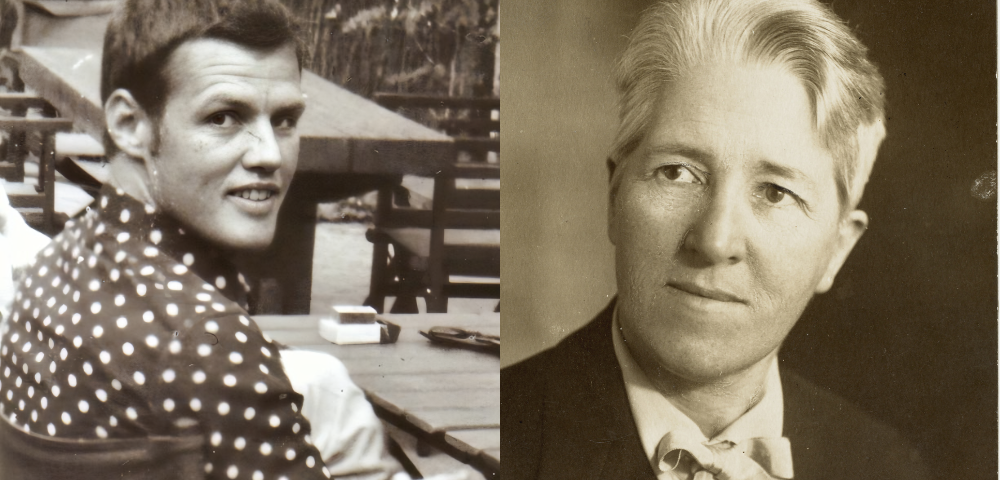

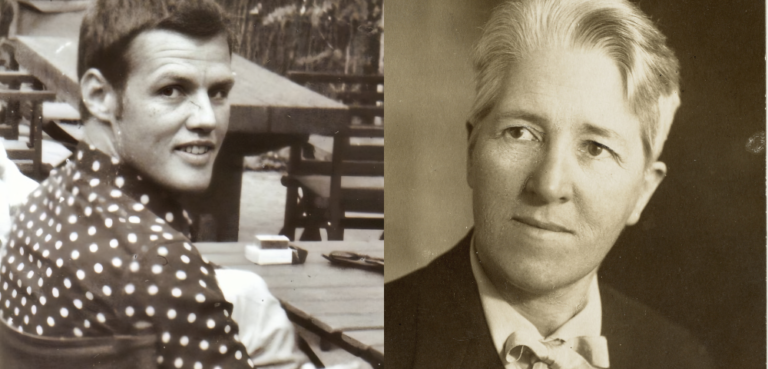

The two leading researchers for this study, Dr. Mustapha Bangura (UTS) and Professor Chyi Lin Lee (UNSW) utilised the weighted average of the eight capital cities in Australia, highlighting significant trends in housing prices. According to The Australian Bureau of Statistics (ABS), there was a 23.7% increase in residential property prices between December 2020 and December 2021.

Cost Of Living Crisis Soars

Sydney continues to be the most expensive city in the country for property. Latest figures for the June quarter reported the median house price for Sydney dwellers to be $1.6 million.

The study found that nowhere in Sydney was affordable based on the 2021 NSW weekly median income. Part-time earners in almost all parts of Sydney would not be able to purchase a property, even if they spent their entire salary on housing.

Aside from a minor decline in affordability during the GFC in 2008-2009 and the COVID-19 pandemic in 2020-2021, the researchers found no substantial improvement in housing affordability. Sydney residents will need to “save significantly and for an extended period to keep their dream of owning a home alive”.

Rising Mortgage Stress

A household is generally considered to be in mortgage stress if they spend more than a certain percentage of their pre-tax income, around 30%, on home loan repayments.

Dr Bangura warned of potential consequences if housing repayments exceeding 30% of income become more common.

“People might have to cut back on their budget, including spending on food and other essentials, to meet their housing expenses,” Dr Bangura said, as reported by ABC News.

“In terms of comparison, Sydney’s unaffordability is the worst. Future studies may look into supply side policies and regulations”, Dr Bangura told CityHub.

CityHub spoke to Professor Chyi Lin Lee about his co-authored report and the implications of the cost-of-living crisis on housing for Sydneysiders.

When asked what the potential social and economic impacts of the predicted unaffordability of housing until at least 2031, Professor Lee stated, “The potential social and economic impacts could be significant. This also highlights the importance of enhancing housing supply, particularly affordable housing in the city area”.

Professor Lee emphasised that investigating ways to boost housing supply was crucial.

“Although this study focuses on Sydney, other major cities such as Melbourne and Brisbane are likely in the similar trend”, Professor Lee noted.

“Enhancing the supply of affordable housing can ease overall market pressures and improve affordability for those looking to buy a home,” Professor Lee said.