The Government’s long-awaited student debt reforms officially began rolling out on Wednesday following the passage of HECS indexation changes in Parliament last month.

Last year, millions of Australians faced a 7.1% increase in their student debts when indexation was applied on June 1, 2023—the highest rate in 30 years.

This marked the first time a significant indexation rate had been applied to Higher Education Loan Program (HELP) debts, sparking widespread anger among tertiary students already struggling with rising living costs and stagnant wages.

Between 2013 and 2021, HECS indexation rates ranged from just 0.6% to 2.6%.

Highest Indexation Increase in 30 years

According to comparison website Finder, the average HECS debt in the 2022–2023 fiscal year was $26 494, up from $24 771 in the previous year, based on ATO figures.

The 7.1% increase last year added an extra $1881 to the average student debt.

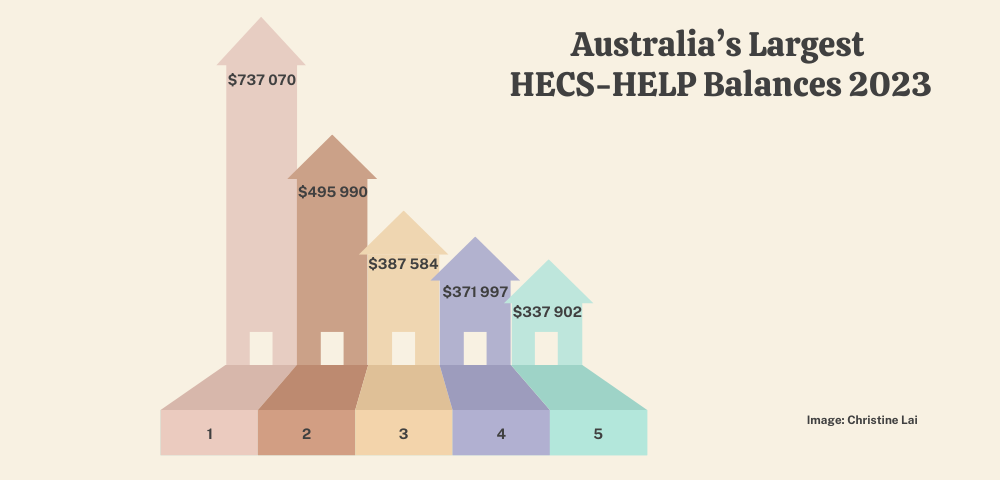

Out of the 2.9 million people with outstanding HECS-HELP debt in 2022–23, nearly 21% of individuals owed over $40,000.

Worryingly, 63% of individuals with HELP debt have expressed concerns about their ability to repay it.

A joint announcement by Minister for Education Jason Clare and Assistant Treasurer and Minister for Financial Services Stephen Jones stated that the backdated change would benefit all Australians with a student debt.

The change aims to “fix last year’s spike in the indexation of 7.1 per cent and prevent indexation from outpacing wages in the future.”

Additionally, if someone has completely repaid their student debt after 2023 or 2024 indexation was applied, the credit will be processed as a refund to their bank account (assuming there are no outstanding government debts).

The Labor Government has stated that they will also cut a further 20 percent off all student loan debts to reduce the debt burden for those with loans by June 1 2025.

Despite the rollout of the HECS rebate and the announcement of a 20% reduction in student loan amounts, many students are calling for further action.

Government’s Rebate Fails to Address Systemic Rise in Tuition Fees

With rising tuition fees and significant course cuts, students are arguing that the government’s efforts have done little to address the escalating financial pressures they are under.

“The government can simply get fucked”, ACU honours student Bridget told City Hub, about the $900 rebate which “barely left a dent” in her over $50 000 HECS debt balance.

Bridget stated that the rebate “doesn’t even cover a quarter of one semester’s thesis units which had no class work, only writing components which were self-driven.”

Additionally, she estimates that it’ll take anywhere from five to ten years to pay off.

“I felt really deflated when I saw how little they gave back to me. It was frankly, underwhelming,” she declared.

NUS calls for debt indexation freeze

Last year the National Union of Students (NUS) called on the Federal Labor Government to freeze student debt indexation to “ease the burden of student debt” and “have the courage to take on the intergenerational wealth crisis in Australia.”

NUS General Secretary Sheldon Gait told ABC News that indexation was a significant concern, stating that despite students making compulsory repayments, their debt would continue to increase.

“We’re already going to be the most indebted generation in history, the first generation to go backwards in terms of our economic outlooks, and we’ve been straddled with this huge student debts which a lot of people in Canberra didn’t have to face with the prospects of free education back in the day,” Gait said at the time.

The government’s latest change – rolling back the indexation, has been underwhelming.

With the standard arts degree projected to exceed $50,000 by 2025 and law degrees set to reach a staggering $85,000 due to the controversial Job-ready Graduates (JRG) package, more urgent action is needed.

Despite a 113% rise in student contributions for communications, humanities, and society and culture degrees, implemented under the JRG scheme, more students than ever have chosen arts.

Data from the UAC university study trends for 2024 shows that Society and Culture (including law) is the second most popular field of study, with 20.6% of applicants selecting a course in this area as their first preference.

Among the popular choices are the University of Sydney’s Bachelor of Arts and Bachelor of Arts/Bachelor of Laws, as well as UNSW Sydney’s Bachelor of Double Law.

University staff demoralised by ongoing cuts

With mass staff cuts sweeping across universities threatening the quality and accessibility of education, and hiked fees, the state of tertiary education has been left in an increasingly compromised position.

At least 200 jobs will be lost at the University of Canberra in a bid to save $50 million in expenditure by the end of next year.

Meanwhile, the Australian National University (ANU) is projected to cut more than 630 positions in a move to reduce staff salary costs by $100 million by January 2026, and the University of Sydney plans to cut between $90 million and $110 million in education spending.

How to check your rebate

Individuals can check their updated student debt balance and see how much their rebate is by logging into their ATO account through myGov.

The debt reduction will roll out over the next few weeks, with those who have already repaid their debt receiving a credit for the difference.