Opposition Leader Peter Dutton has come under fire for not explaining how his plan to cause a gas glut in eastern Australia will lead to sustained energy bill relief.

The long-awaited modelling released by the Coalition claims that its policy to hold back more liquefied-gas shipments from Queensland will slash wholesale gas prices to $10 a gigajoule, easing household gas bills by 7 per cent a year. According to modelling from Frontier Economics, this would also cut power bills by 3 per cent, because gas-fired generators supply about 10 per cent of the electricity consumers draw from the grid.

However, on Wednesday, energy experts rebutted those claims. They said that the modelling failed to consider the added costs of $2-$4 involved in transporting gas from Queensland to consumers in the more populous south-east.

The Coalition last week clarified it only intended to cut gas prices to $10 at Queensland’s Wallumbilla gas hub.

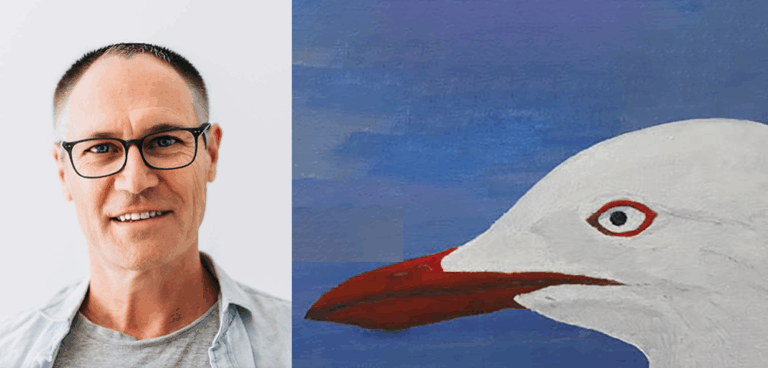

According to Rick Wilkinson, chief executive of consultancy EnergyQuest, after the cost of piping gas south is added in, the new policy is “not going to make any difference” to the current prices in the southern markets. The average cost in NSW is $12.28, and in Victoria it’s slightly higher at $12.97.

“Getting gas from Wallumbilla to Sydney costs $2.36, and if you want to move it down to Melbourne, that’s an extra 58¢,” Wilkinson said. “That gets you to $12.94.”

Something else that the policy fails to cover is how the extra gas held back from export can be sent to the southern states in the first place; the only pipeline linking Queensland to the south is already usually at capacity in the winter, which is also when gas is most needed for heating.

“If you don’t have pipeline capacity or storage, you aren’t actually adding anything,” Wilkinson said.

The Coalition’s “Australian gas for Australians” scheme – a pitch to voters struggling with energy bills and other living costs – would force exporters of super-chilled liquefied natural gas (LNG) to hold back a significant amount of their “uncontracted” volumes to shore up domestic supplies.

Queensland’s LNG exporters sell most of their gas on long-term contracts to buyers in Asia, and then the rest of their supply is divided up between one-off deliveries on both the international LNG spot market and domestic sales in Australia. Two of the state’s LNG giants, APLNG venture and QCLNG, are among Australia’s biggest east-coast domestic suppliers, contributing around 40 percent of all gas used in cooking, heating, power, and manufacturing.

The Coalition’s plan would force them to go even further and reserve another 50–100 petajoules a year, enough to cover 20 per cent of the entire east-coast market.

Most industrial gas users, including companies in the manufacturing sector, have welcomed the policy.

“Gas prices above $10 per gigajoule are simply untenable in a gas-rich country like Australia,” said Ben Eade of Manufacturing Australia, whose members include companies such as BlueScope Steel and Brickworks.

The Australia Institute, a progressive think tank, also supported the gas-reserve plan as a “turning point”.

”Dutton is rightfully arguing Australia has an abundance of gas and that all we need to do is to tax gas exports to ensure our gas flows first to Australian businesses and households,” executive director Richard Denniss said. “This is a big shift.”

Long-term logistics don’t make sense.

However, others are a bit skeptical about the logic of flooding the market with so much extra gas. Gas producers caution that forcing an oversupply of gas priced below the cost of producing it would erase any incentive for them to drill for supplies beyond what they need for their export contracts.

This could raise the risk of gas shortages and price spikes later in the decade when the Australian Energy Market Operator is forecasting a shortage in Victoria and NSW.

“No one is going to invest in supply at that price,” said one industry source, not authorised to speak publicly.

Samantha McCulloch, chief executive of gas industry association Australian Energy Producers, said Frontier’s modelling left “many unanswered questions”.

“There would be no incentive to produce sub-economic gas, and it would damage already suppressed investor confidence,” McCulloch said.

On Wednesday, the coalition was asked questions about the logistics of the reservation plan, and how it was supposed to ease the cost of living when the modelling showed the annual power bill saving just a mere $1 a week.

Dutton said the policy would keep a lid on gas prices following a 34 per cent price rise since Labor was elected in 2022, and insisted it would benefit consumers by ensuring lower costs across parts of the economy that depend on affordable gas.

“We are talking about flat-lining and reducing prices … not just in household bills but also the cost of the builder who’s buying steel, the farmer who’s buying fertiliser,” he said. “If we can bring down that cost for every part of the economy that relies on gas and the use of gas to create and generate electricity, the difference between the two parties is quite staggering.”

Wilkinson said Frontier’s modelling suggested the Coalition had not considered the long-term risks.

“The unintended consequences could make matters worse,” he said.